#Fintech

#UX/UI

#Figma

Designing an Intuitive Cash Send Feature

Designing an Intuitive Cash Send Feature

Designing an Intuitive Cash Send Feature

Designing an Intuitive Cash Send Feature

Designing an Intuitive Cash Send Feature

Designing an Intuitive Cash Send Feature

In the rapidly evolving financial technology landscape, the need for quick, secure, and convenient methods of transferring funds is paramount. This case study explores the design and implementation of a new "Cash Send" feature for the Spot app, aimed at addressing the unique challenges and needs of its users.

In the rapidly evolving financial technology landscape, the need for quick, secure, and convenient methods of transferring funds is paramount. This case study explores the design and implementation of a new "Cash Send" feature for the Spot app, aimed at addressing the unique challenges and needs of its users.

In the rapidly evolving financial technology landscape, the need for quick, secure, and convenient methods of transferring funds is paramount. This case study explores the design and implementation of a new "Cash Send" feature for the Spot app, aimed at addressing the unique challenges and needs of its users.

In the rapidly evolving financial technology landscape, the need for quick, secure, and convenient methods of transferring funds is paramount. This case study explores the design and implementation of a new "Cash Send" feature for the Spot app, aimed at addressing the unique challenges and needs of its users.

In the rapidly evolving financial technology landscape, the need for quick, secure, and convenient methods of transferring funds is paramount. This case study explores the design and implementation of a new "Cash Send" feature for the Spot app, aimed at addressing the unique challenges and needs of its users.

In the rapidly evolving financial technology landscape, the need for quick, secure, and convenient methods of transferring funds is paramount. This case study explores the design and implementation of a new "Cash Send" feature for the Spot app, aimed at addressing the unique challenges and needs of its users.

Timeline

2021 - 2024

Role

Lead UX & UI

Timeline

2021 - 2024

Role

Lead UX & UI

Timeline

2021 - 2024

Role

Lead UX & UI

Timeline

2021 - 2024

Role

Lead UX & UI

Timeline

2021 - 2024

Role

Lead UX & UI

Background

Background

The brief centered on developing an easy and instant method for Spot app users to send and receive cash. The primary goal was to integrate a user-friendly solution that could provide a seamless experience while adhering to the financial constraints and requirements of the target market.

The brief centered on developing an easy and instant method for Spot app users to send and receive cash. The primary goal was to integrate a user-friendly solution that could provide a seamless experience while adhering to the financial constraints and requirements of the target market.

Challenge

Challenge

Users of the Spot app faced several difficulties with existing cash transfer methods.

Users of the Spot app faced several difficulties with existing cash transfer methods.

1

High costs and the inconvenience of ATM withdrawals.

1

High costs and the inconvenience of ATM withdrawals.

1

High costs and the inconvenience of ATM withdrawals.

1

High costs and the inconvenience of ATM withdrawals.

1

High costs and the inconvenience of ATM withdrawals.

2

Lack of instant payment options to other banks within the app.

2

Lack of instant payment options to other banks within the app.

2

Lack of instant payment options to other banks within the app.

2

Lack of instant payment options to other banks within the app.

2

Lack of instant payment options to other banks within the app.

3

A desire for anonymous payment capabilities.ence of ATM withdrawals.

3

A desire for anonymous payment capabilities.ence of ATM withdrawals.

3

A desire for anonymous payment capabilities.ence of ATM withdrawals.

3

A desire for anonymous payment capabilities.ence of ATM withdrawals.

3

A desire for anonymous payment capabilities.ence of ATM withdrawals.

4

The need for a convenient and secure method to send cash or store value.

4

The need for a convenient and secure method to send cash or store value.

4

The need for a convenient and secure method to send cash or store value.

4

The need for a convenient and secure method to send cash or store value.

4

The need for a convenient and secure method to send cash or store value.

These challenges highlighted the necessity for a robust solution that could simplify the money-sending process while ensuring security and user satisfaction.

These challenges highlighted the necessity for a robust solution that could simplify the money-sending process while ensuring security and user satisfaction.

Solution

Solution

To address these challenges, the design focused on two main strategies

To address these challenges, the design focused on two main strategies

1

Streamlined Decision-Making

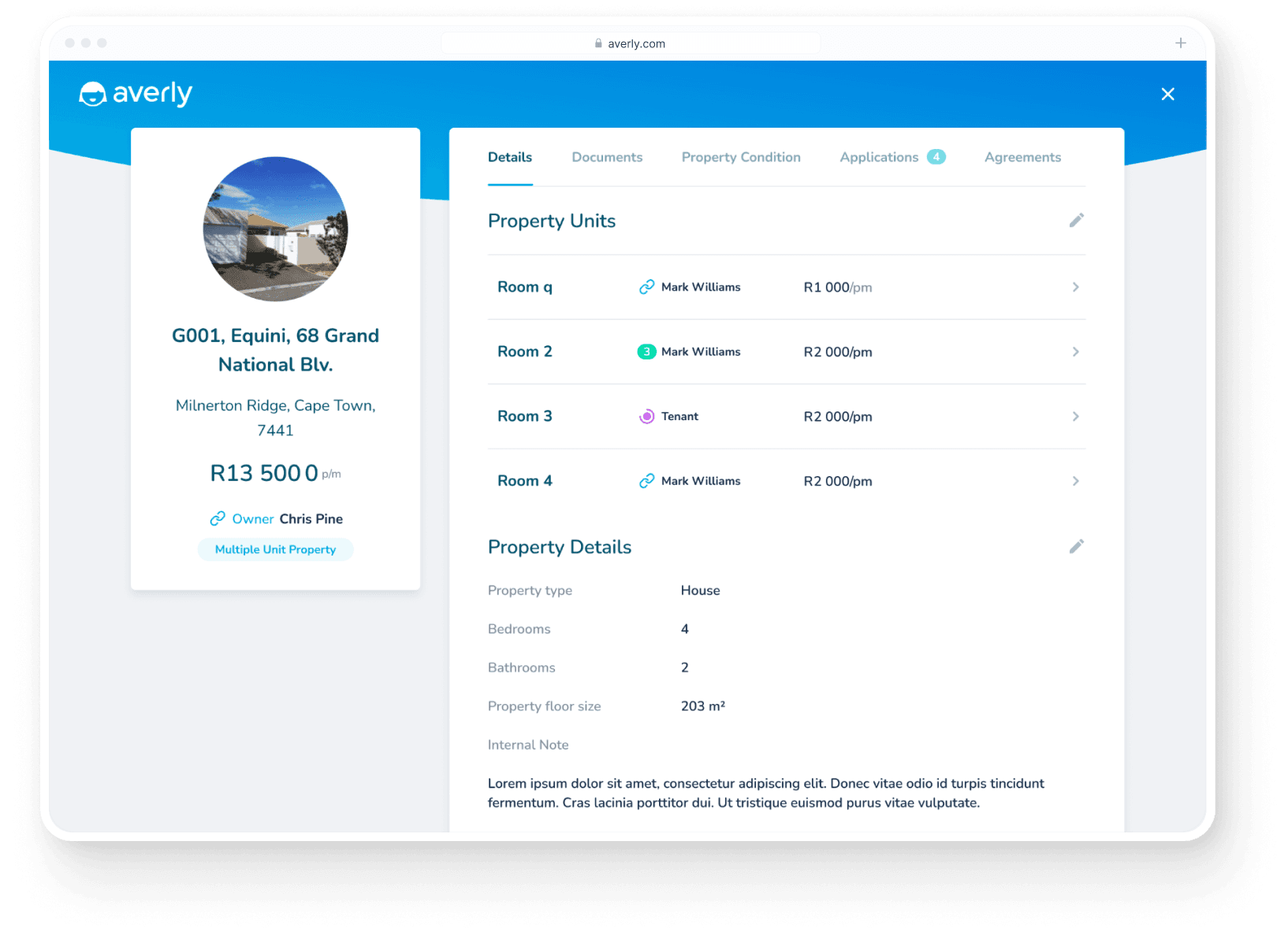

This design option aimed to simplify the user's journey in sending cash by presenting three clear initial choices: sending funds to an existing contact, a new contact, or to themselves. This approach reduced the complexity and streamlined the process, maintaining minimal changes to the existing flow of the app.

1

Streamlined Decision-Making

This design option aimed to simplify the user's journey in sending cash by presenting three clear initial choices: sending funds to an existing contact, a new contact, or to themselves. This approach reduced the complexity and streamlined the process, maintaining minimal changes to the existing flow of the app.

1

Streamlined Decision-Making

This design option aimed to simplify the user's journey in sending cash by presenting three clear initial choices: sending funds to an existing contact, a new contact, or to themselves. This approach reduced the complexity and streamlined the process, maintaining minimal changes to the existing flow of the app.

1

Streamlined Decision-Making

This design option aimed to simplify the user's journey in sending cash by presenting three clear initial choices: sending funds to an existing contact, a new contact, or to themselves. This approach reduced the complexity and streamlined the process, maintaining minimal changes to the existing flow of the app.

1

Streamlined Decision-Making

This design option aimed to simplify the user's journey in sending cash by presenting three clear initial choices: sending funds to an existing contact, a new contact, or to themselves. This approach reduced the complexity and streamlined the process, maintaining minimal changes to the existing flow of the app.

2

Delight and Clarity

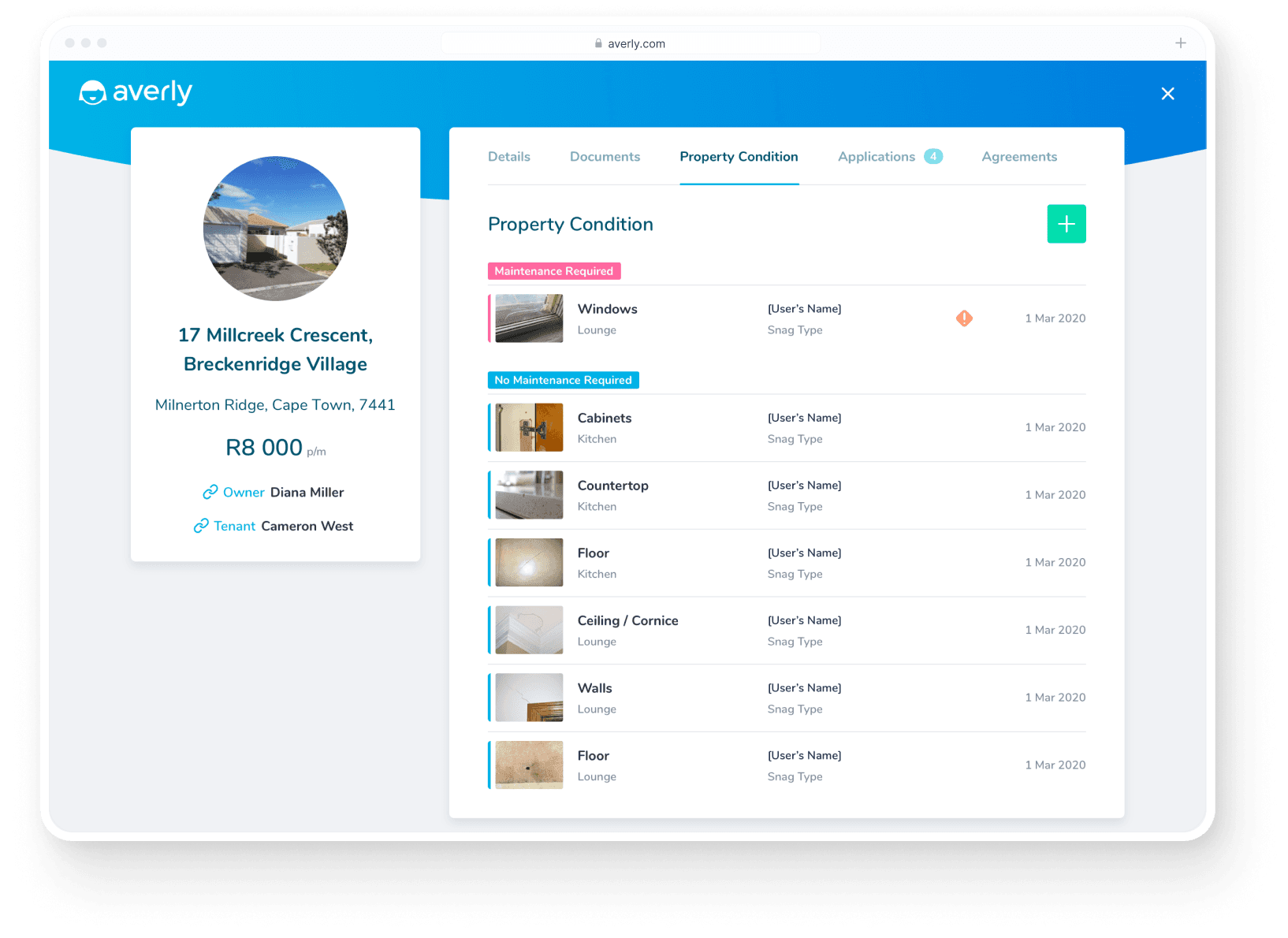

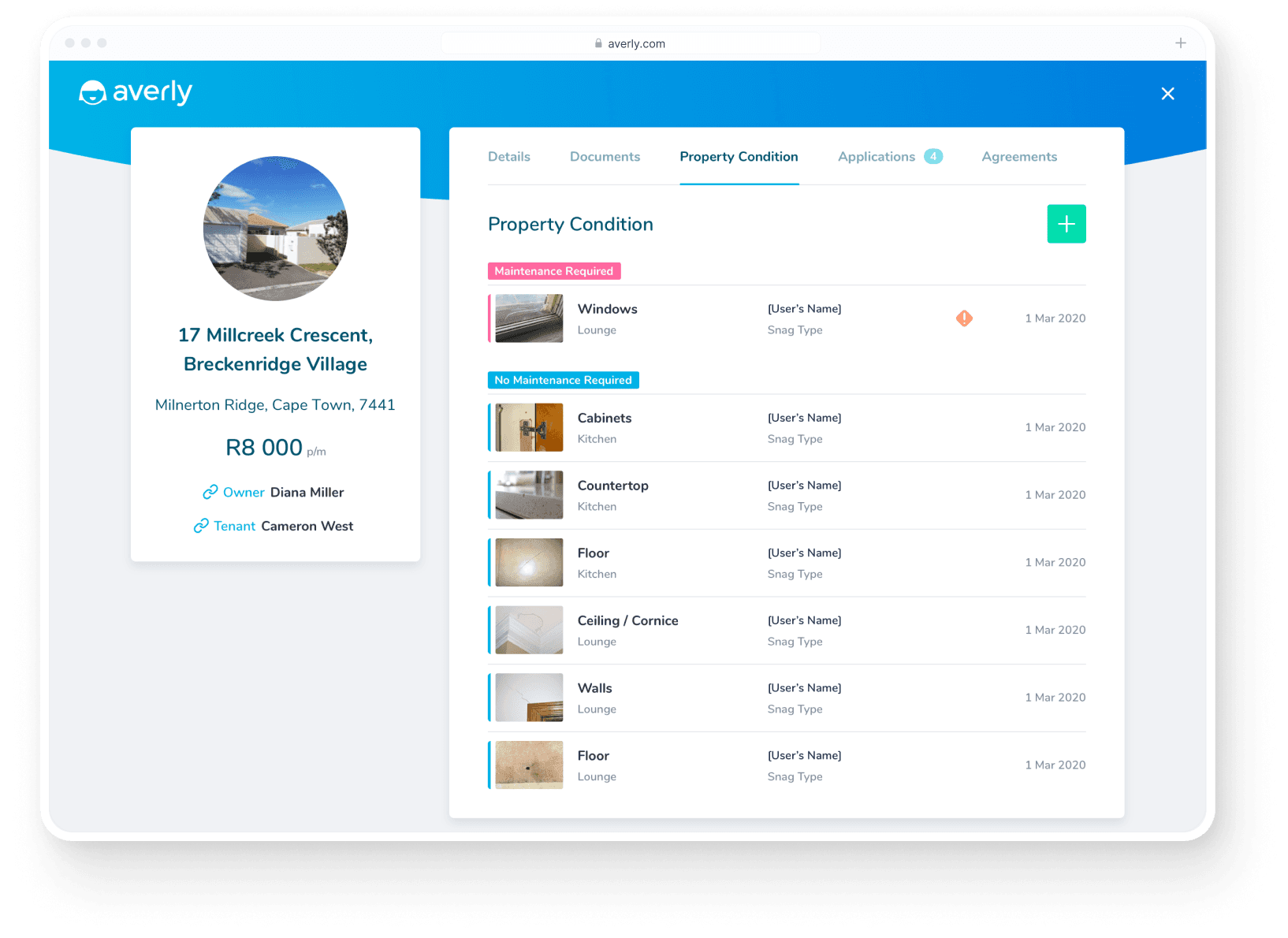

The transaction flow concludes with positive reinforcement through a confirmation message and redirection to the homepage for easy access to transaction history. Transactions are clearly labeled with the recipient's name or mobile number, with indicators for 'Success' or 'Expired'. First-time users see an informational screen to guide them through the process, accessible later via an info icon, enhancing clarity and user experience without repetition.

2

Delight and Clarity

The transaction flow concludes with positive reinforcement through a confirmation message and redirection to the homepage for easy access to transaction history. Transactions are clearly labeled with the recipient's name or mobile number, with indicators for 'Success' or 'Expired'. First-time users see an informational screen to guide them through the process, accessible later via an info icon, enhancing clarity and user experience without repetition.

2

Delight and Clarity

The transaction flow concludes with positive reinforcement through a confirmation message and redirection to the homepage for easy access to transaction history. Transactions are clearly labeled with the recipient's name or mobile number, with indicators for 'Success' or 'Expired'. First-time users see an informational screen to guide them through the process, accessible later via an info icon, enhancing clarity and user experience without repetition.

2

Delight and Clarity

The transaction flow concludes with positive reinforcement through a confirmation message and redirection to the homepage for easy access to transaction history. Transactions are clearly labeled with the recipient's name or mobile number, with indicators for 'Success' or 'Expired'. First-time users see an informational screen to guide them through the process, accessible later via an info icon, enhancing clarity and user experience without repetition.

2

Delight and Clarity

The transaction flow concludes with positive reinforcement through a confirmation message and redirection to the homepage for easy access to transaction history. Transactions are clearly labeled with the recipient's name or mobile number, with indicators for 'Success' or 'Expired'. First-time users see an informational screen to guide them through the process, accessible later via an info icon, enhancing clarity and user experience without repetition.

3

Additional Features

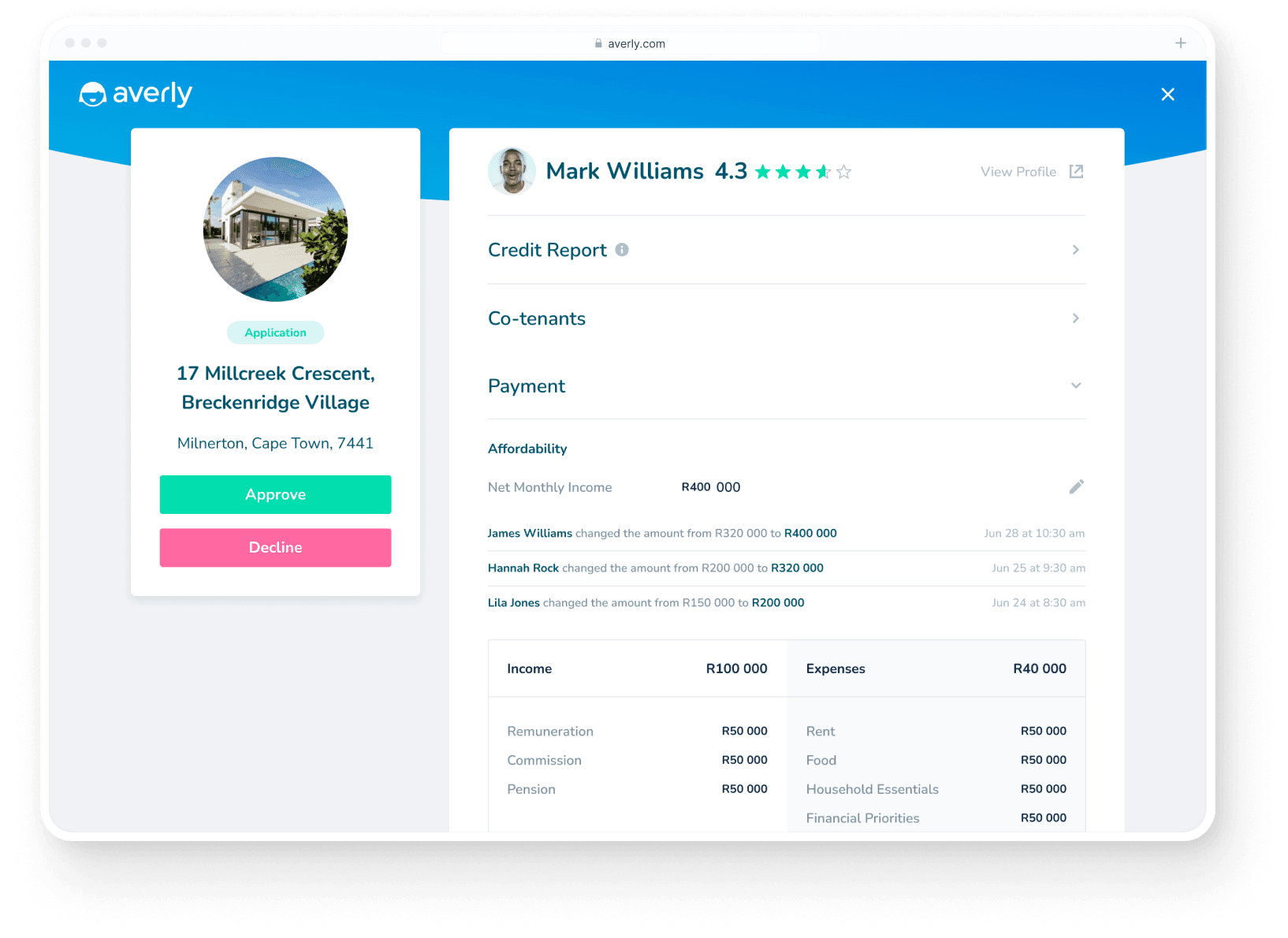

The Cash Send feature includes a dedicated option under the "Send Money" tile, utilizing Flash vouchers for transactions. Users can send money to contacts or new numbers, choosing funds from wallets or a linked card. An auto-generated 16-digit PIN secures each transaction. The maximum amount per transaction is R500, with vouchers expiring after 7 days. If unused, funds automatically revert to the sender’s primary wallet.

3

Additional Features

The Cash Send feature includes a dedicated option under the "Send Money" tile, utilizing Flash vouchers for transactions. Users can send money to contacts or new numbers, choosing funds from wallets or a linked card. An auto-generated 16-digit PIN secures each transaction. The maximum amount per transaction is R500, with vouchers expiring after 7 days. If unused, funds automatically revert to the sender’s primary wallet.

3

Additional Features

The Cash Send feature includes a dedicated option under the "Send Money" tile, utilizing Flash vouchers for transactions. Users can send money to contacts or new numbers, choosing funds from wallets or a linked card. An auto-generated 16-digit PIN secures each transaction. The maximum amount per transaction is R500, with vouchers expiring after 7 days. If unused, funds automatically revert to the sender’s primary wallet.

3

Additional Features

The Cash Send feature includes a dedicated option under the "Send Money" tile, utilizing Flash vouchers for transactions. Users can send money to contacts or new numbers, choosing funds from wallets or a linked card. An auto-generated 16-digit PIN secures each transaction. The maximum amount per transaction is R500, with vouchers expiring after 7 days. If unused, funds automatically revert to the sender’s primary wallet.

3

Additional Features

The Cash Send feature includes a dedicated option under the "Send Money" tile, utilizing Flash vouchers for transactions. Users can send money to contacts or new numbers, choosing funds from wallets or a linked card. An auto-generated 16-digit PIN secures each transaction. The maximum amount per transaction is R500, with vouchers expiring after 7 days. If unused, funds automatically revert to the sender’s primary wallet.

Conclusion

Conclusion

The newly designed Cash Send feature for the Spot app successfully bridges the gap between user needs and the technological capabilities of modern financial apps. By focusing on user experience, security, and convenience, the feature not only meets the identified needs but also enhances customer satisfaction and engagement with the app. This case study reflects a significant step forward in making financial transactions more accessible and user-friendly, showcasing a robust model for future enhancements in the fintech sector.

The newly designed Cash Send feature for the Spot app successfully bridges the gap between user needs and the technological capabilities of modern financial apps. By focusing on user experience, security, and convenience, the feature not only meets the identified needs but also enhances customer satisfaction and engagement with the app. This case study reflects a significant step forward in making financial transactions more accessible and user-friendly, showcasing a robust model for future enhancements in the fintech sector.

Tools

Tools

Figma

Adobe

Figma

Adobe

Figma

Adobe

Figma

Adobe

Figma

Adobe

More projects